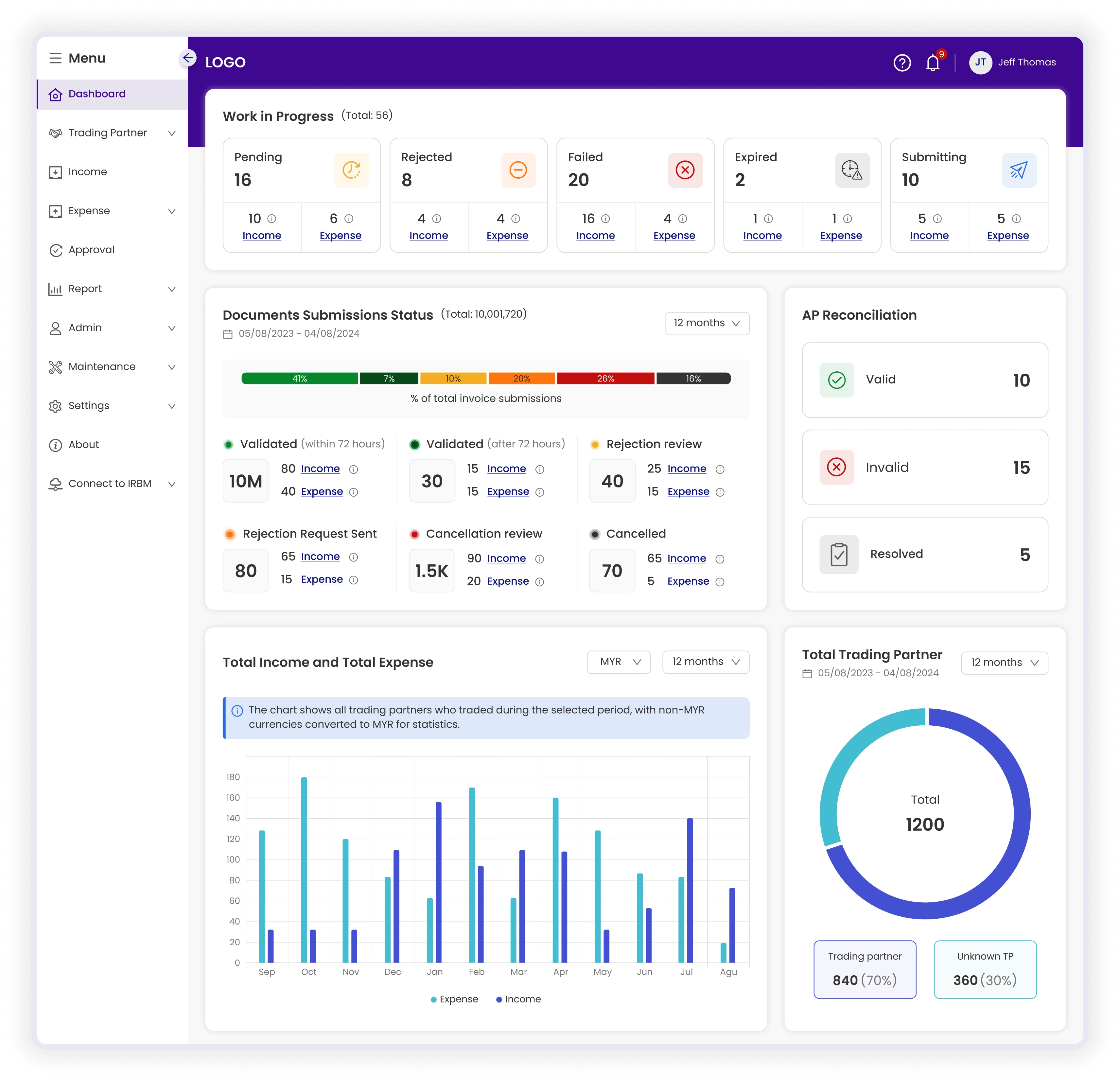

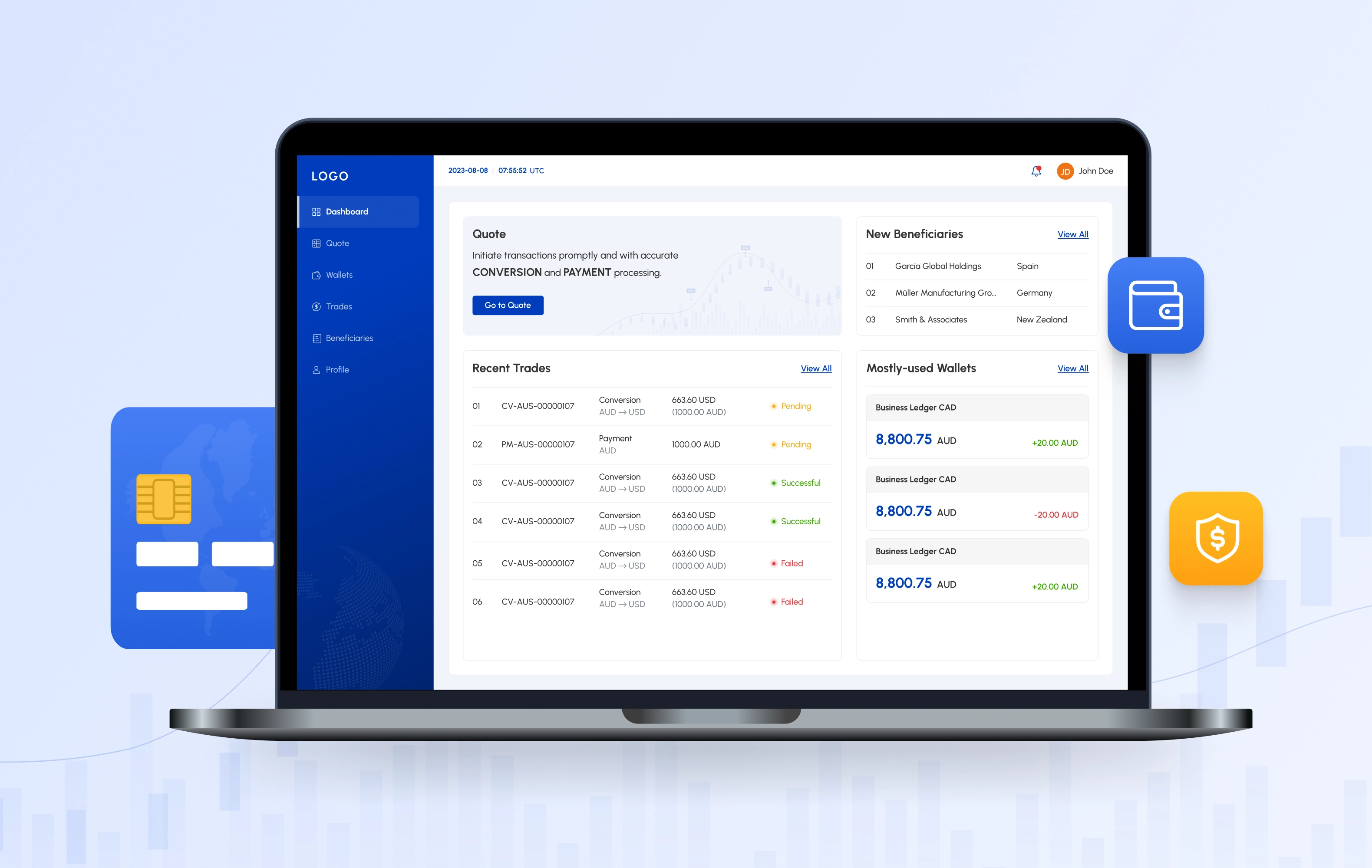

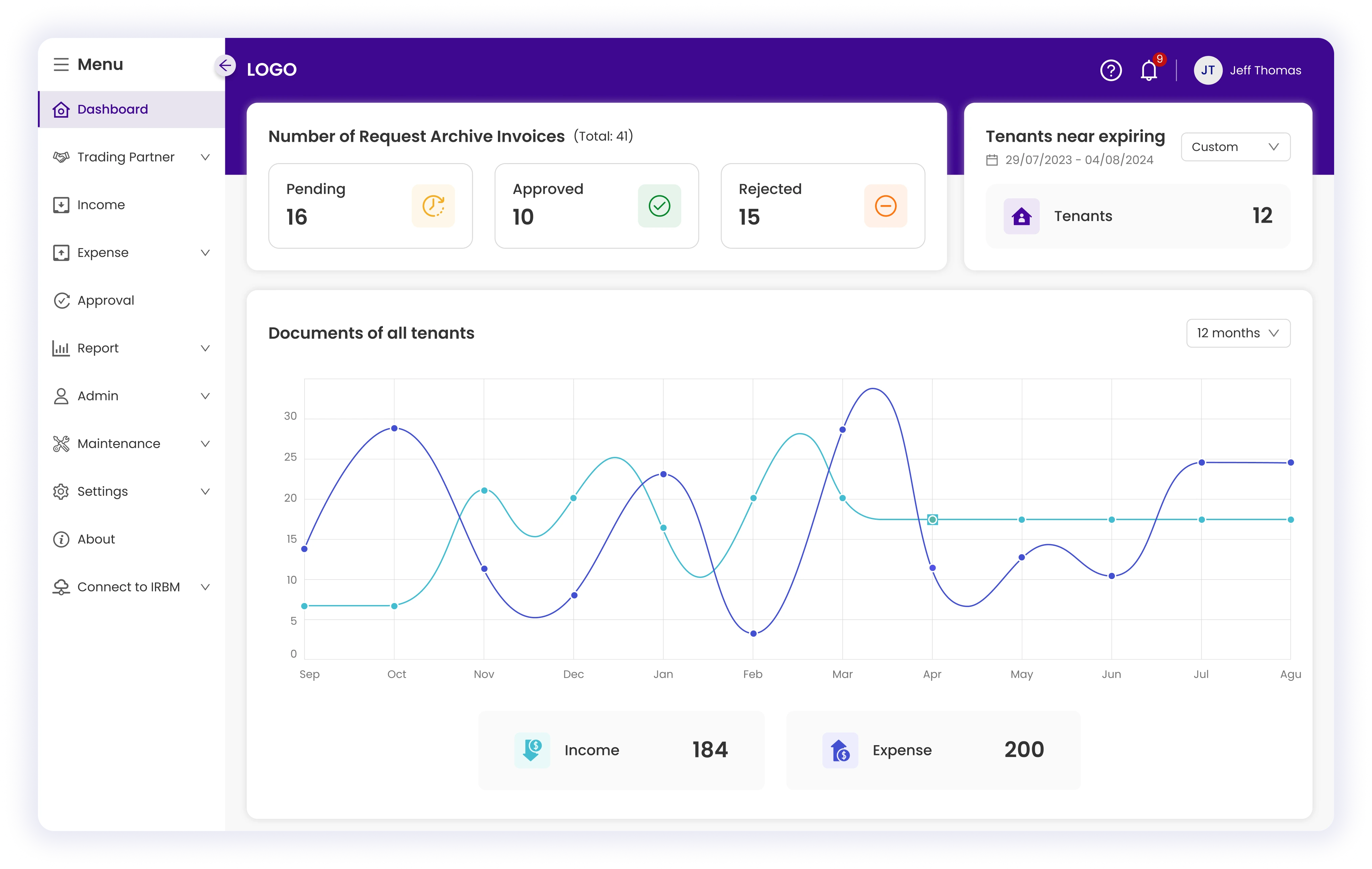

Building a corporate tax management system that balances government regulations and business efficiency requires careful strategy. Our solution effectively addresses multiple challenges while delivering an intuitive user experience.

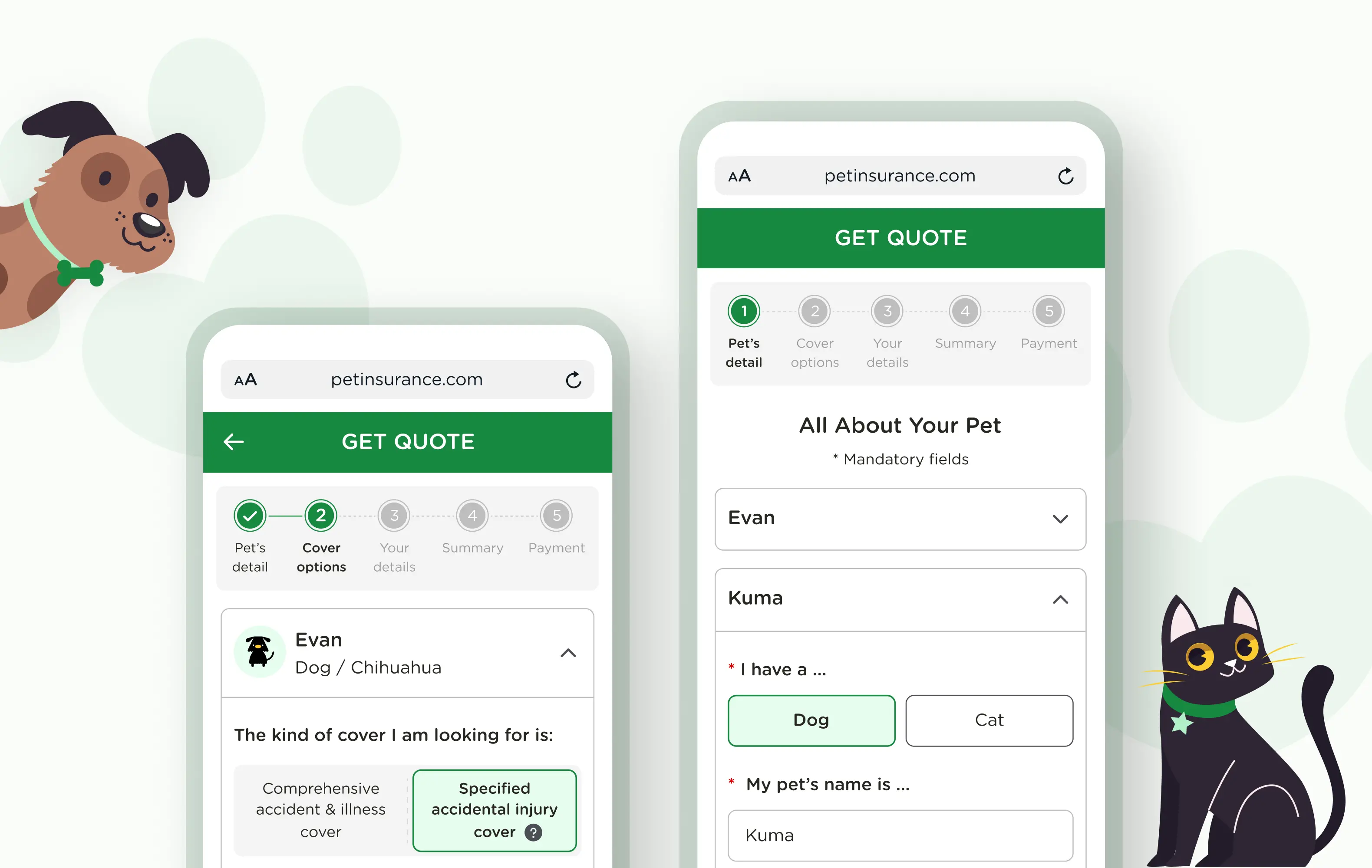

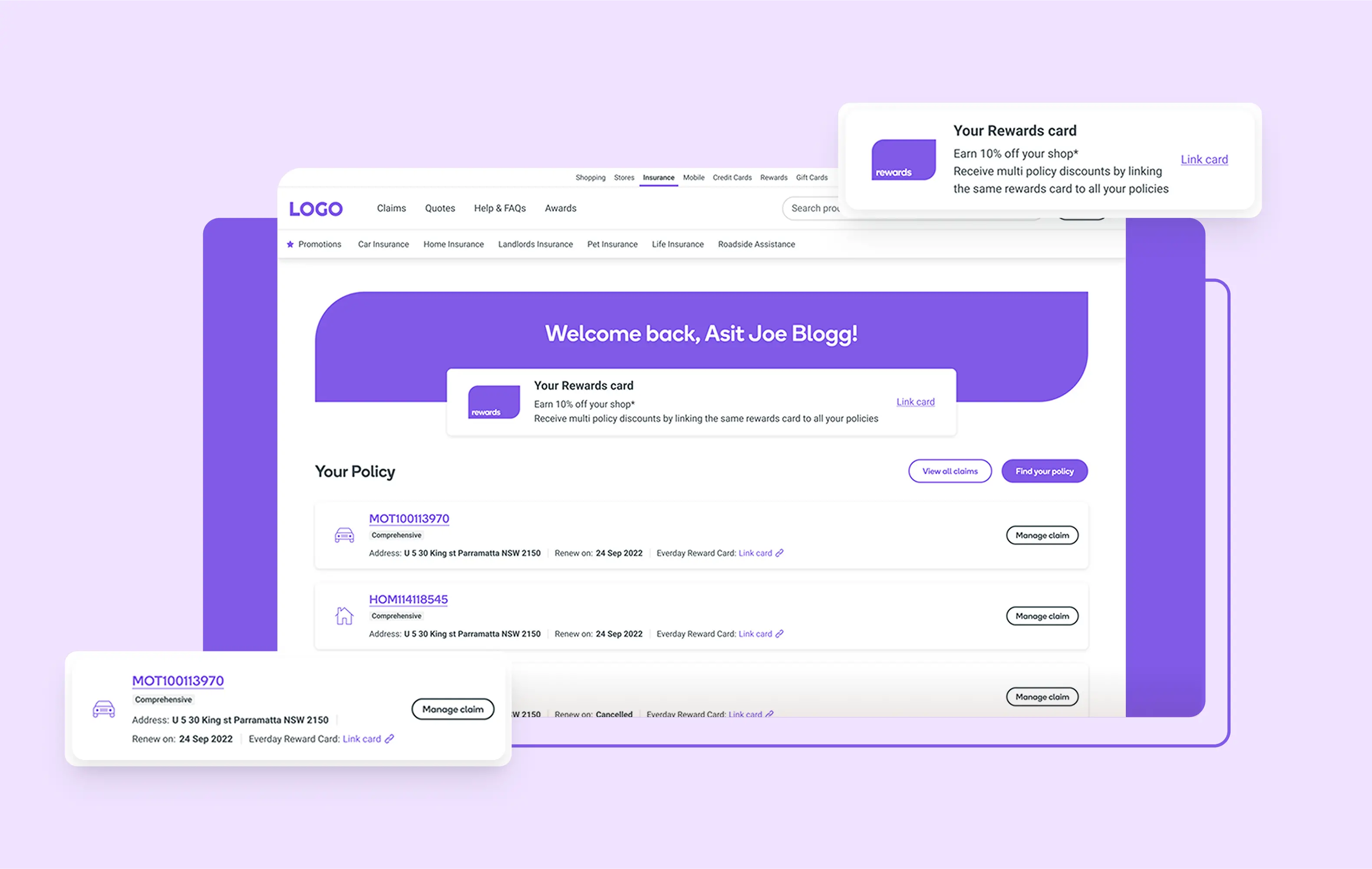

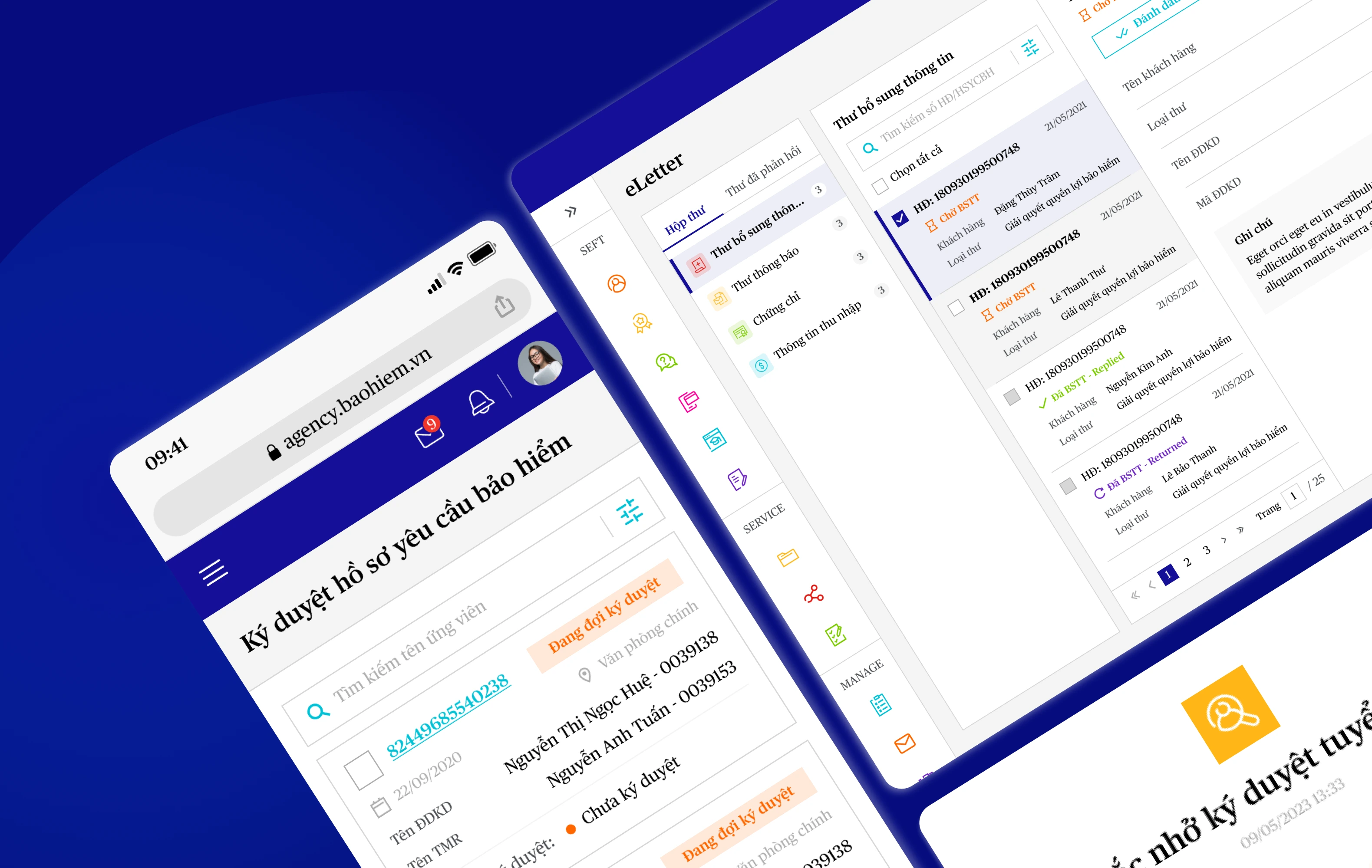

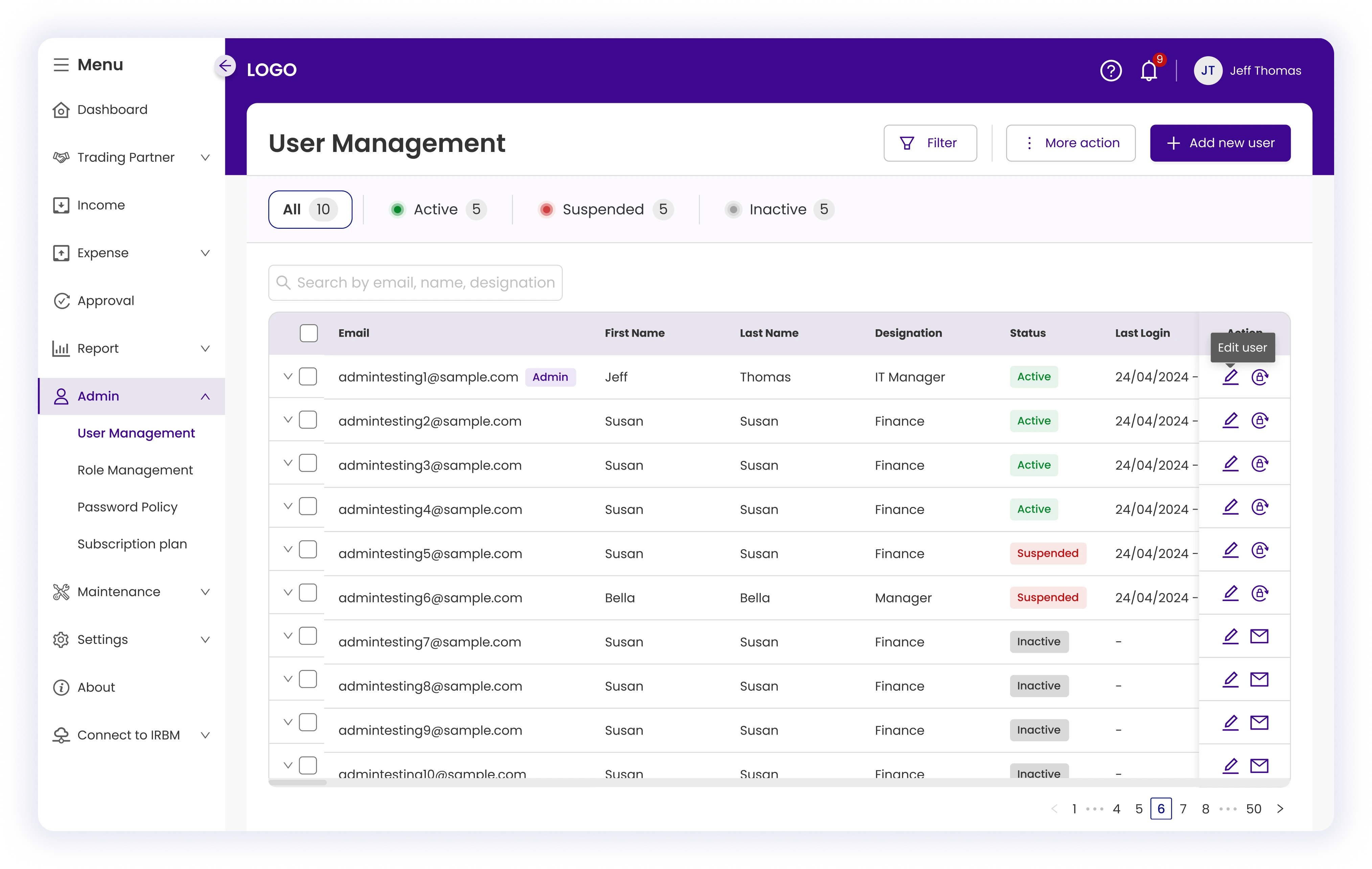

A key challenge was ensuring the system easy to use for its target users—primarily female working professionals, with limited technical expertise. Since they primarily operate on desktop interfaces, our design prioritizes clarity, simplicity, and an intuitive user flow to enhance adoption and efficiency.

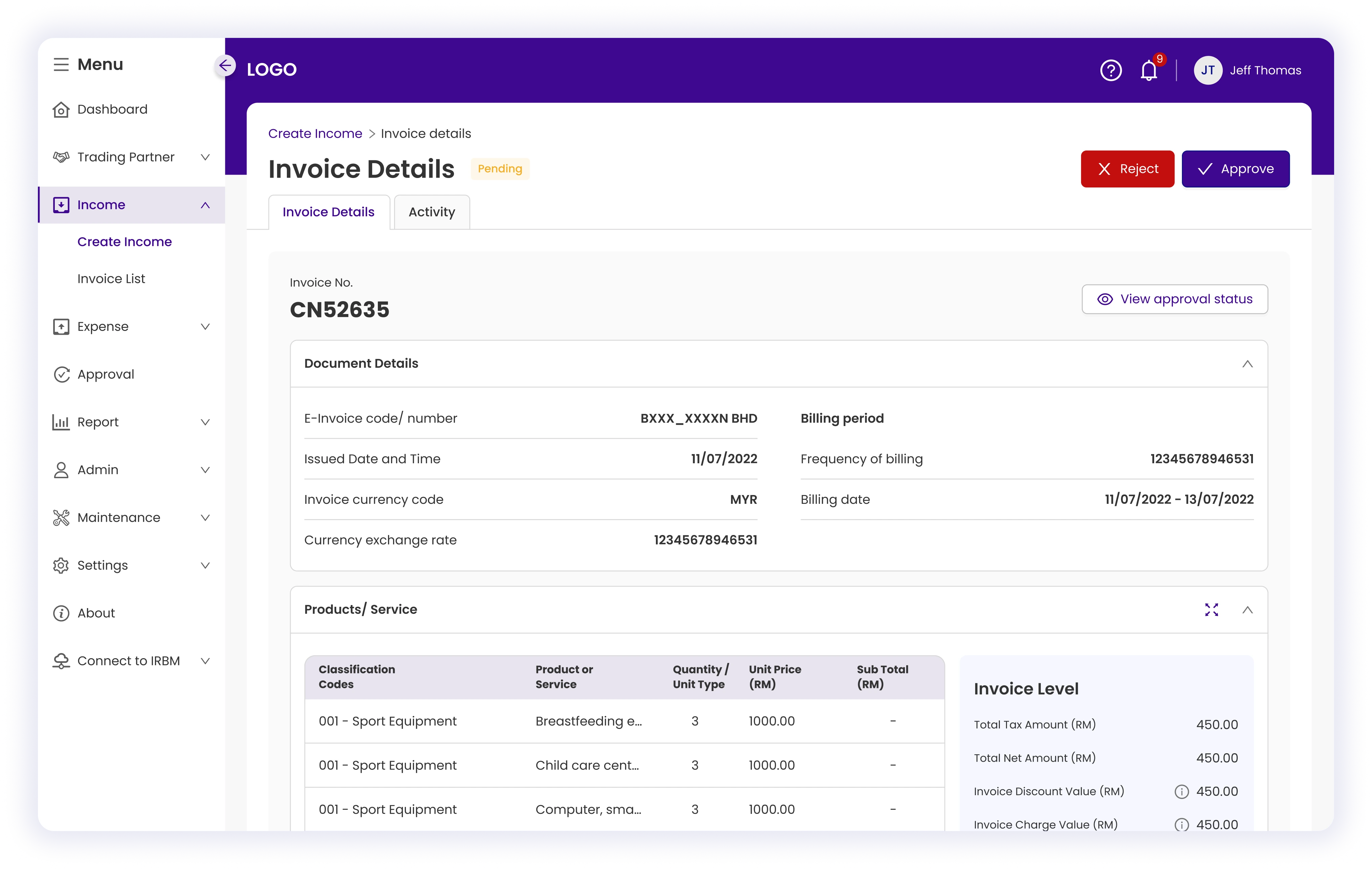

To gain government approval, our new system securely connects with Malaysia's tax authority via API. This ensures accurate and reliable data exchange for tax submissions and retrievals.

The system is built to handle vast amounts of tax data from businesses of all sizes, from small enterprises to large corporations. Our focus on optimization ensures smooth performance, even when managing high data volumes.

We have implemented a robust role-based access system (Admin, Tenant Admin, User, Tenant User) to control permissions and streamline workflows for various user types.

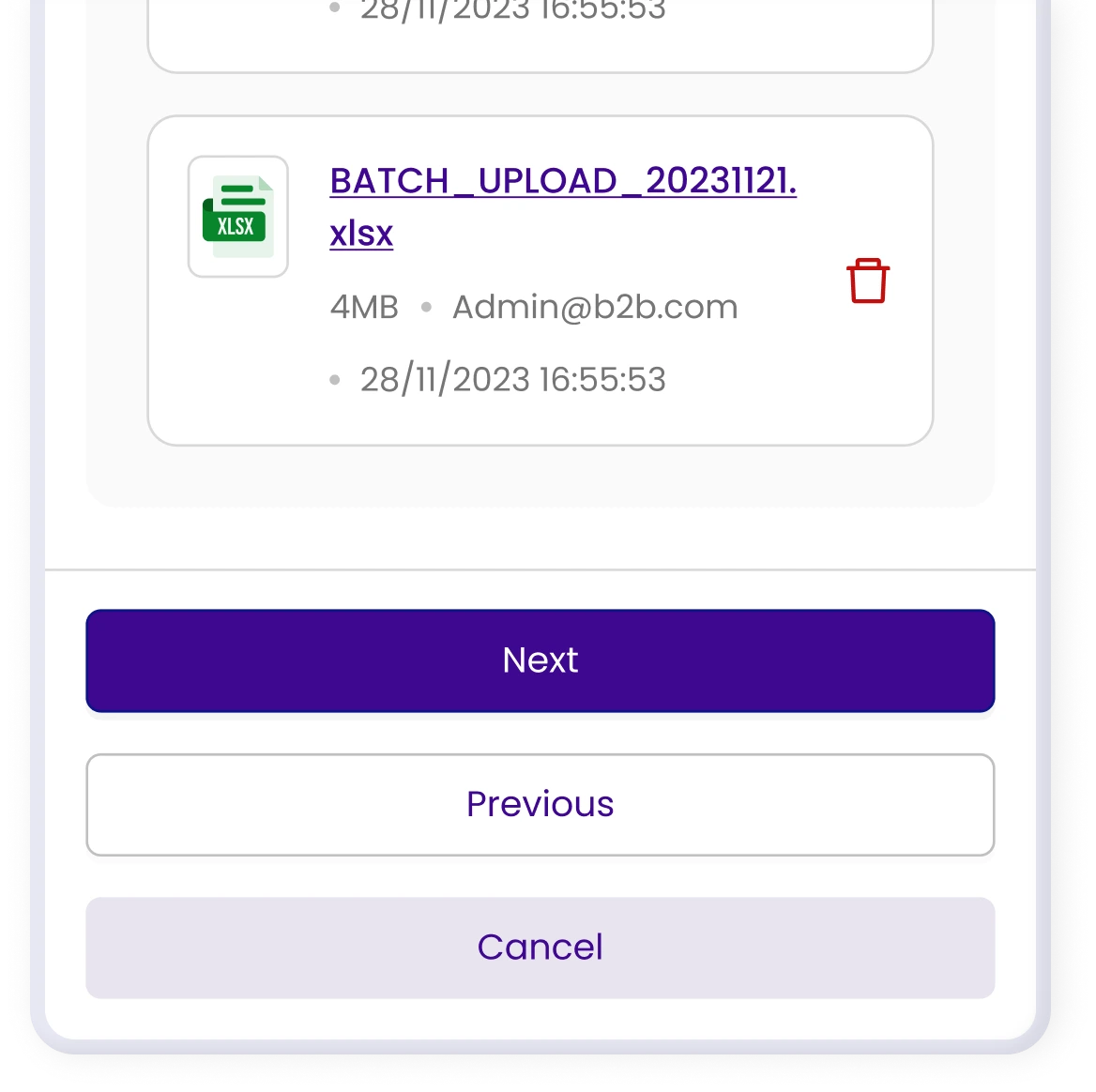

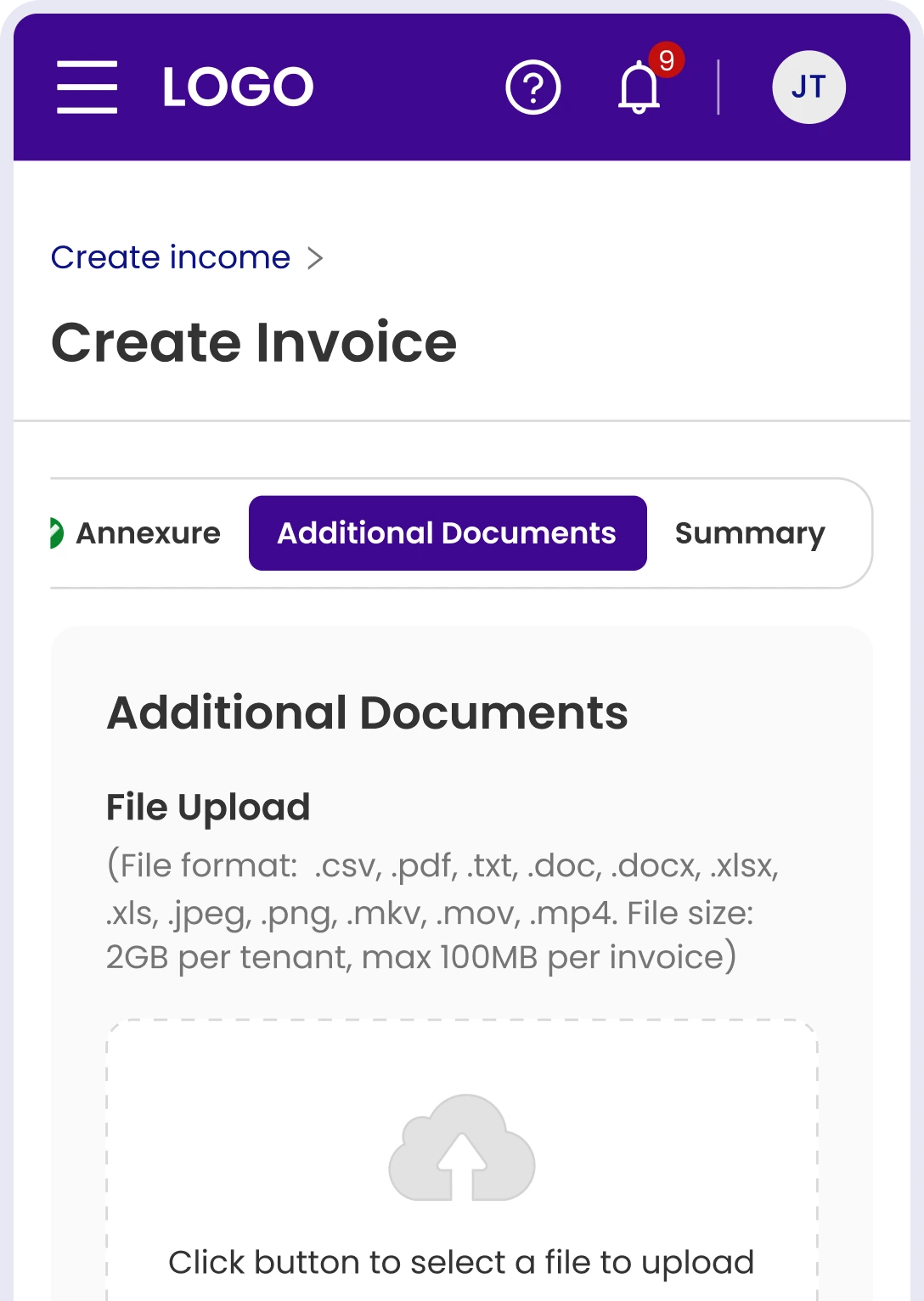

While optimized for desktop, the platform is fully responsive across mobile and tablet devices (both landscape and portrait orientations), ensuring accessibility and flexibility for users on the go.

Conclusion

Conclusion

With a seamless integration of regulatory compliance, scalability, and user-centric design, our Enterprise Tax Administration System revolutionizes the way businesses manage taxation. It simplifies complex workflows, enhances financial transparency, and ensures secure data exchange—empowering enterprises to stay compliant while focusing on sustainable growth.